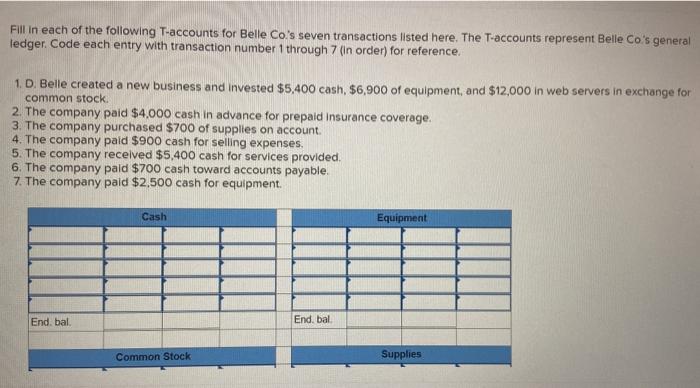

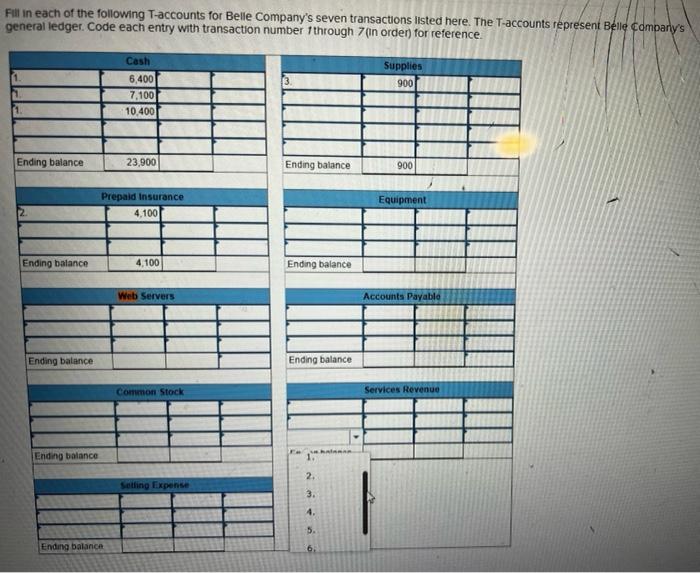

The transactions of belle company appear below – The transactions of Belle Company, presented below, provide a comprehensive overview of the company’s financial activities. Analyzing these transactions is essential for understanding the company’s financial position and performance.

This document delves into the types of transactions, their impact on Belle Company’s financial statements, and the internal controls in place to ensure their accuracy and reliability. It concludes with recommendations for enhancing the company’s financial reporting process.

Introduction

The transactions of Belle Company provide valuable insights into the company’s financial activities and their impact on its financial position. Analyzing these transactions is crucial for understanding the company’s performance, profitability, and overall financial health.

Transaction Analysis

Types of Transactions

The transactions of Belle Company can be categorized into several types, including:

- Sales transactions: These transactions involve the sale of goods or services to customers, resulting in revenue for the company.

- Purchase transactions: These transactions involve the purchase of goods or services from suppliers, resulting in expenses for the company.

- Cash transactions: These transactions involve the receipt or disbursement of cash, affecting the company’s cash balance.

- Non-cash transactions: These transactions involve the exchange of non-cash assets, such as the acquisition or disposal of property or equipment.

Impact on Financial Position, The transactions of belle company appear below

The transactions of Belle Company have a significant impact on the company’s financial position. Sales transactions increase the company’s revenue and assets, while purchase transactions increase the company’s expenses and liabilities. Cash transactions affect the company’s cash balance, which is an important indicator of the company’s liquidity.

Non-cash transactions can also affect the company’s financial position, as they can result in changes to the company’s assets and liabilities.

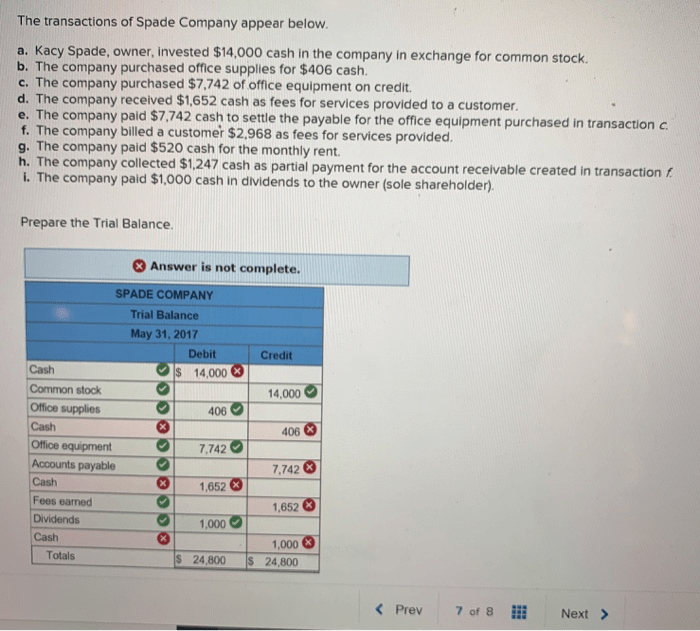

Financial Statement Impact: The Transactions Of Belle Company Appear Below

The transactions of Belle Company are reflected in the company’s financial statements, including the balance sheet, income statement, and cash flow statement. Sales transactions increase the company’s revenue and accounts receivable on the balance sheet, while purchase transactions increase the company’s expenses and accounts payable.

Cash transactions affect the company’s cash balance on the balance sheet. Non-cash transactions can also affect the balance sheet, as they can result in changes to the company’s fixed assets or other non-current assets.

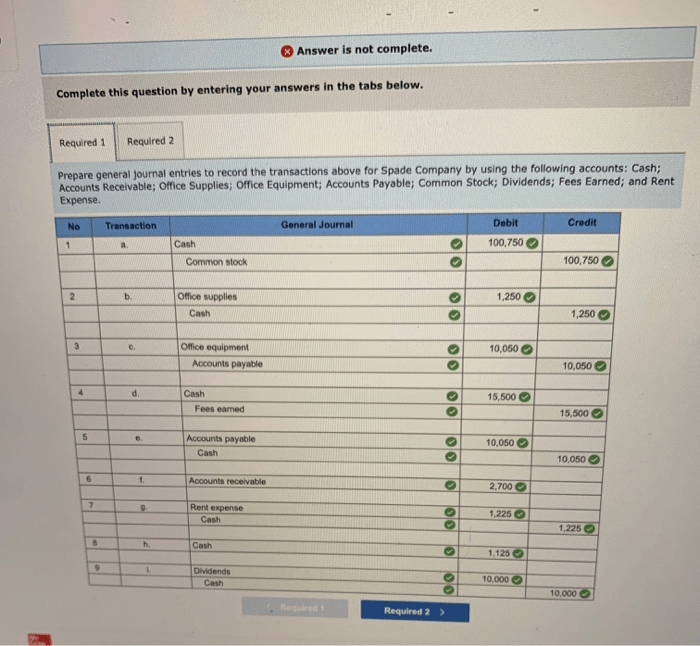

Internal Controls

Internal controls are essential for ensuring the accuracy and reliability of the transactions of Belle Company. These controls should include procedures for:

- Authorizing transactions

- Recording transactions

- Reconciling transactions

- Reviewing transactions

FAQ Guide

What is the purpose of analyzing the transactions of Belle Company?

Analyzing the transactions of Belle Company helps to understand the company’s financial position, performance, and cash flows.

What types of transactions are included in the analysis?

The analysis includes all types of transactions that affect the company’s financial statements, such as sales, purchases, expenses, and investments.

How do the transactions impact the financial statements of Belle Company?

The transactions impact the balance sheet, income statement, and cash flow statement of Belle Company. For example, sales transactions increase revenue and assets, while expense transactions decrease net income and assets.

What internal controls are in place to ensure the accuracy and reliability of the transactions?

Belle Company has implemented various internal controls, such as segregation of duties, authorization procedures, and reconciliation processes, to ensure the accuracy and reliability of its transactions.